Image Id 681123 for Node 255602

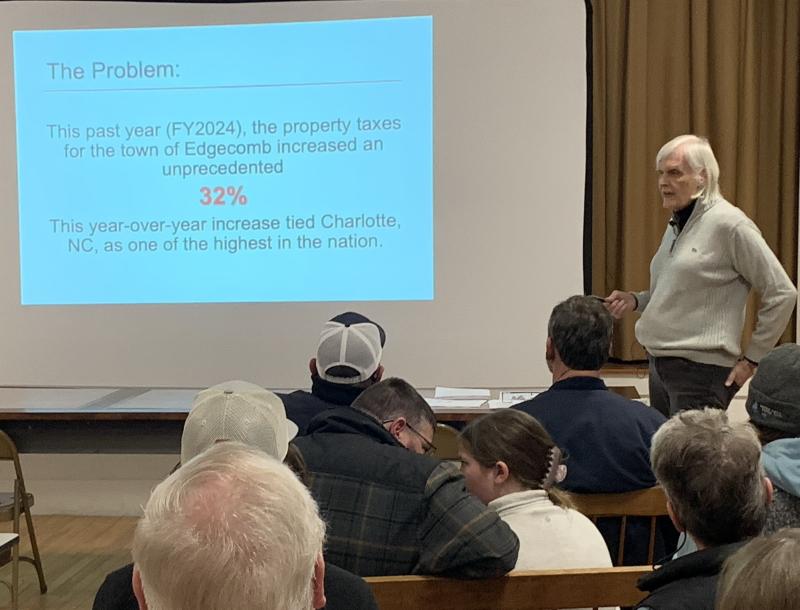

Gale Willauer is one of over 50 Edgecomb residents who attended the Citizen's Tax Group presentation March 4 about the sharp rise in property taxes. In January, she received a mailing, "Why did your property taxes increase by 32%?" This question definitely sparked her interest.

"I heard she (Dr. Kate Rohr) was impressive, and she was," Willauer said about the 90-minute presentation on recent municipal and school budget trends in Edgecomb. "Our taxes went up 32%, and that is unsustainable. Something has to be done so that's why I'm here. I'm so impressed with the amount of research they did. I'm just blown away."

Rohr is part of a group of 20 seasonal and year-round residents who created it after meeting with selectmen last fall. Residents attended the first board meeting after tax bills were received seeking answers to the unexpected 32% property tax increase.

Selectmen encouraged the group to become more involved in the process. So Rohr and Stuart Smith became the group's charter members and organized this volunteer budget investigation team. The group spent nine months compiling data and reported their findings to selectmen on March 4. Business owners, professionals, educators and engineers participated in the research. The group studied past municipal and school actions seeking a trend regarding spending increases.

Smith said the group explored "every school board meeting minute since 2017, selectboard minutes since 2012 and all available audits."

The group's analysis pointed toward large spending increases in the school and fire department and municipal offices as the biggest factor in double-digit budget increases.

For Willauer, the report was a reasonable explanation for last year's 32% property tax hike."The school budget was up a million dollars last year for this little town. That's amazing," she said. "And you know, this (report) is not an opinion. It's all fact-based research."

The group reported Edgecomb teachers and support staff are among the Midcoast's highest paid educators, but student performance lagged behind regional students. "The Edgecomb Eddy School is falling behind other local schools, based on accepted comparable metrics. There is no apparent plan to determine the cause and rectify this downward trend," Rohr said.

Following the presentation, audience members questioned the group's data. A female resident described the group's data as biased.

Edgecomb Eddy teacher Sarah Currier challenged why the group focused so much on the school, instead of the fire department. A Citizens' Tax Group member said the school accounts for 60% of the tax bill.

Rohr also said a major rise in the fire department's budget last year was creating a $62,400 full-time fire chief. "There are no other towns our size with a full-time chief. so it's difficult to compare," she said.

Detractors noted the report didn't mention higher property tax bills as a trend throughout the state. True, but one resident put it in perspective. He said he paid property tax in four towns and never had a bill increase by more than $2,100. In those towns, he received police, water, sewer and garbage, and gets none of that in Edgecomb. He called that unbelievable.

The group reports optional educational programs like pre-kindergarten have a significant cost and non-resident tution "has no demonstrated benefit for resident students while increasing the cost for taxpayers." The group suggests school budgets understate expected revenue and overstate expenses. "This leads to large fungible surpluses and higher than necessary tax assessments," Rohr said.

The group's final recommendation was a required detailed school plan for rectifying declining academics metrics.

Following the meeting, Smith reported strong public support. "I think it went over well from the feedback we are receiving," he said. A second presentation is scheduled for 1 p.m. Saturday, March 8 in the town hall. The presentation can also be seen on the YouTube channel "Everything Local."