MECEP’s Prosperity Budget food for thought during budget season

The Maine Center for Economic Policy (MECEP) unveiled the Prosperity Budget at its annual Policy Insights conference in January. Lauded by MECEP's analysts as a “blueprint for shared growth and opportunity,” the budget is the culmination of about a year of research to expand services in education, healthcare, and state and municipal infrastructure and creating a permanent commission on race equity, all while matching increased spending with increased revenue.

“One of the things you will see MECEP doing in the next couple of years is some more intentional work to connect with and engage with Maine people,” said executive director Garrett Martin as he reflected on the Center’s focus on student loans and broad spectrum economic policy.

The Prosperity Budget sets forth two-year budget goals of fully funding pre-K-12 schools at a cost of $320 million; fully funding adult education, $8 million; increasing funding to early childhood education by $40 million; tripling the State of Maine Grant, $62 million; and fulfilling paid sick and family leave and strengthening workers’ rights, $23 million.

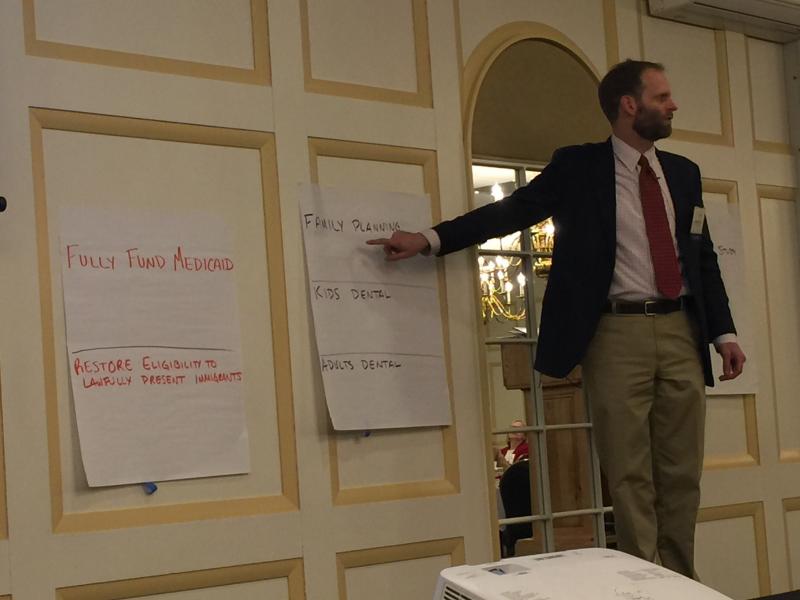

Healthcare funding would include fully funding Medicaid, $110.5 million; restoring eligibility of legal immigrants, $7.5 million; funding dental care, $12.8 million; family planning, $10 million; substance abuse mitigation, $22 million; and elderly and disability services, $142.3 million.

The commission on race equity would cost $600,000 and infrastructure spending would total $23 million over two years not counting municipal revenue sharing which is already included by statute.

MECEP policy analyst Sarah Austin said the plan to raise necessary revenue starts with the income tax.

“This is our best, broad-based progressive tax that we have to work with,” said Austin.

Those earning $56,000 or less per year would see a decrease in income taxes while those earning between that mark and $186,000 would see a slight increase. The next two brackets, $186,000 to $435,000 and $435,000 and over, would see respective increases of 0.6 percent and 1.7 percent.

This new interpretation of the code would bring in $308 million over the two years.

“By tripling our state (income tax) credit we can boost incomes for low and middle income Mainers by $22 million a year," Austin added. "Our revenue plan also cleans up some loopholes and modernizes our tax code.”

Restoring estate tax levels to pre-2011 levels would net $24 million in fiscal year 2021, eliminating offshore tax havens would create another $5 million, and updating hospital tax assessments would create $17 million in 2020 and another $24 million in 2021.

Said Austin, “Right now in statute, until something is changed, the hospital tax will be assessed on 2014 profits forever. All this is doing is making sure the current year of profits for hospitals is the year that their taxes are assessed on and there is a lot of revenue there to help fund health priorities in the state.”

Austin said an extra source of revenue could be found by increasing the meals and lodging taxes by one percent and two percent respectively. This would yield another $140 million.

“(The) final piece here is to draw down a portion of the surplus we have good reason to believe will be sustainable into out-years to help fill out the rest of the revenue needs,” Austin said; it would draw just over $260 million from the fund over the two years.

Maine House District 53 Rep. Allison Hepler,D - Woolwich, was one among several state legislators at the conference to hear MECEP’s thoughts on Maine moving forward with intentionally progressive policy.

“Many conversations need to continue to happen and not just where we live, but across the state,” Hepler said in an interview.

Conversations should not be limited just to legislators either, Hepler added; businesses interested in supporting initiatives that bring paid sick leave, family leave or increased wages should be talking to one another.

“There needs to be a better understanding of not only the big picture for Maine — the need for an educated work force, young people moving here, work force development — but how it plays out on the ground, in small towns as well as big cities, in the north as well as south. One size does not fit all.”

Hepler said there is no reason incentives cannot be used instead of mandates.

“What sorts of federal dollars can be used to promote economic development and provide a positive environment for young and/or new Mainers?”

Asked if progressive initiatives, like the Prosperity Budget, coming out of the conference might be able to gain traction with more moderate and conservative groups, Hepler said she is only sure of one thing: “Other than the need for more conversation, I think Mainers of all stripes support economic development, workforce training, and livable wages.”

As Maine gears up for passing a two-year budget by June, Martin said MECEP’s focus will continue to be on building an inclusive economy involving a state budget which will lay the foundation for economic equity across the board.

Said Martin, “Clearly we've got a lot of work cut out for us, but we don't do that work alone. (It) is informed ... by research and analysis (and) perspective and experiences of our partners ... of lawmakers ... of Maine people.”

Event Date

Address

United States