Electricity rip-off: Private electricity suppliers cost Mainers an extra $132 million in seven years

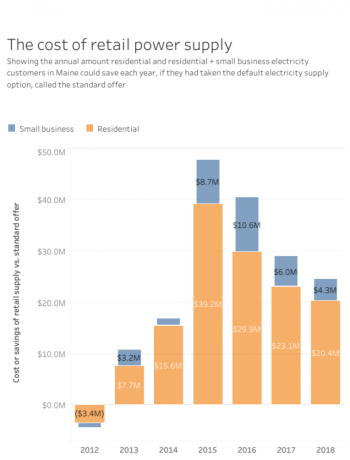

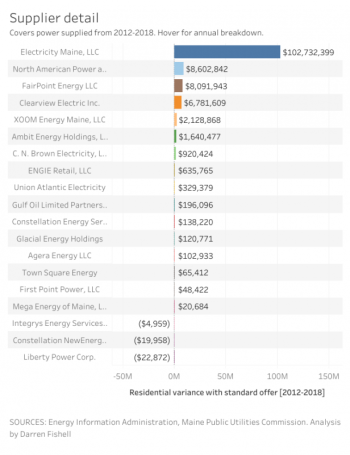

Mainers have spent $132.5 million more than they needed to on electricity over the past seven years.

It’s not because of a faulty billing system or a mistake.

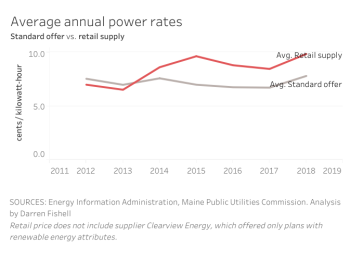

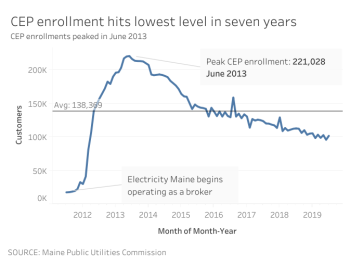

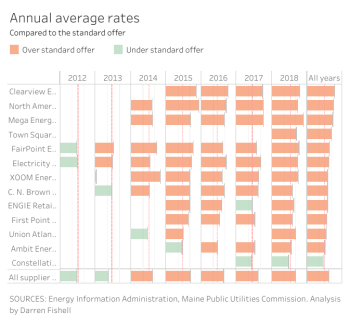

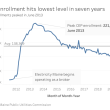

It’s because of a legal market for reselling electricity to residential customers that blossomed in 2012 and since 2014 has struggled to compete with the power Mainers get by default, called the standard offer.

The rate from so-called “competitive electricity providers,” or CEPs, can be pennies or fractions of a penny different. When you count that difference across millions of kilowatt-hours and hundreds of thousands of customers in Maine, however, it adds up fast.

As a result, the state’s public advocate wants lawmakers to consider shutting down the entire market, and customers of the largest CEP — Electricity Maine — are nearing a settlement in a multi-million dollar class-action lawsuit. Regulators are still considering penalties for the state’s largest supplier.

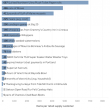

In 2018 alone, Maine residential customers paid CEPs $20 million they didn’t need to, according to a Pine Tree Watch analysis of the latest annual reports filed with the U.S. Energy Information Administration.

The total is $33.2 million higher when estimating for small business costs, using state power consumption data and federal data from 2012 to 2018.

In lieu of competing on price, unscrupulous retail electricity salespeople have used animosity toward utilities like Central Maine Power Co. to their advantage, marketing their product as a way to reject the big utilities.

But that is misleading, as CMP and Emera do not supply standard offer power.

Sen. David Woodsome (R-York) has sponsored a bill to eliminate the retail competitive electricity market altogether, on behalf of Public Advocate Barry Hobbins’ office.

“I don’t necessarily agree with completely getting rid of the competitive providers,” Woodsome said. “I do think there’s been a lot of problems with these companies.”

Since 2012, there have been legislative moves to rein in competitive power suppliers in Maine, as regulators in Maryland and Connecticut have taken action to curb abuses in the market.

Maine lawmakers in 2017 passed a new consumer protection law placing limits on customer re-enrollments and price increases.

Earlier this year, the public advocate recommended a one-year suspension and a $1 million fine against Electricity Maine, with a decision still pending from the Public Utilities Commission, which regulates the sector.

Maine separated utilities from power generators in 2000, but none of those suppliers targeted the residential market until 2011.

Woodsome said that he has heard from constituents who are confused about who exactly is responsible for their power bill going up. The way the system works, that’s understandably confusing. Utilities still handle all billing, so it’s always CMP or Emera’s name at the top.

“CMP has enough issues without being blamed for something they’re not responsible for,” Woodsome said, referring to the company’s various controversies, including a power line crossing the state and a bungled rollout of a new billing system.

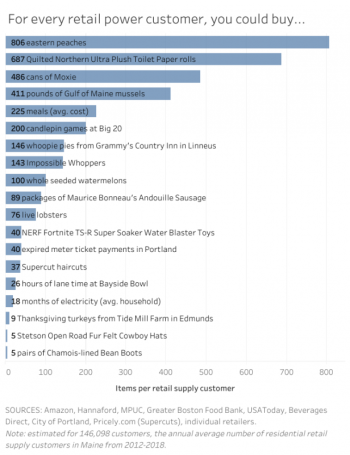

But to put the retail electricity problem in that perspective: the amount residential customers have lost to private electricity sellers could have paid for all of CMP’s troubled billing system, twice.

In other words, every household in Maine could instead get 21 one-pound lobsters, or six one-pound lobsters and a pair of chamois-lined Bean Boots, for the price of an electricity rip-off now in its seventh year.

On the record

Emile Clavet and Kevin Dean, two serial entrepreneurs based in Auburn, pioneered the residential power market in 2011 when they founded Electricity Maine. In their first year, they saved Mainers $3.3 million and quickly grew to more than 150,000 customers. The rates they charged that year were 5.7 percent lower than the standard offer.

By 2018, Electricity Maine had cost its residential customers $100 million more than the standard offer.

The company led a surge in residential customers enrolling with CEPs, which has tapered off in recent years.

Customers have since sued Electricity Maine and its founders, alleging they were deceived into higher-cost power plans over multiple years. The case is nearing a settlement, according to court filings.

Though Clavet and Dean sold the company in 2016 to the Texas-based Spark Energy, neither has spoken out publicly to account for Clavet’s 2011 lie to customers: “We will always beat the standard offer. You’ll never, ever pay more than the standard offer, or we won’t be back.”

The filings reveal contradictions in Clavet’s public statements. While he derided a report by regulators confirming how much his customers would have saved with default power price, he also described trying to sign up new customers as a “futile effort” because Electricity Maine had higher prices in 2016 and 2017.But Clavet was forced to speak in court filings last year, in response to the class-action lawsuit and a civil suit he filed against his now estranged business partner, Dean, over a land deal in Texas.

In a July deposition, Clavet provided his version of what happened in 2014, when the company began violating his public promise.

“The way that [regulators] procure [the] standard offer changed so we were competing with a different product,” Clavet said. “We would compare ourselves to standard offer for different reasons at different times because standard offer was evolving and changing continuously.”

In 2013, the company’s radio ads stated: “Just grab your power bill. If on page two it says ‘standard offer,’ you’re paying too much.”

Regulatory records show how the company pivoted to new marketing tactics after prices began to creep above the standard offer, emphasizing being a local, Auburn-based company that supported area nonprofits.

The new strategy involved quietly re-enrolling existing customers at higher rates and sending renewal notification emails. Internal records obtained in the class-action lawsuit showed about half of the company’s customers never opened their emailed renewal notices.

The re-enrollments did not turn the tide, however. According to Dean, “the power companies had losses of over $14,000,000 and were in trouble” in 2015.

Meanwhile, supplier Dead River Co., which had a base of existing home heating customers, saw where electricity prices were headed and called it quits in 2014, writing to customers: “The escalating cost of natural gas has contributed to the increased cost of electricity. As a result, many electricity supply providers increased their rates to levels above the Standard Offer, costing consumers more on their energy bills. Dead River Company upheld its promise to offer you savings by keeping our rates below the Standard Offer.”

“It was a little bit discouraging because, you know, to get anywhere really with it, you had to sell a lot of electricity at a pretty strong price compared to what the current market was to a fair number of customers using, you know, a method, which for us was mostly direct mail that yielded very few results,” Clavet said.

At the time of Electricity Maine’s sale, Spark estimated it would cost about $80 to acquire a new customer. Suppliers like Ambit Energy have defrayed that cost using a multi-level marketing approach, where they give customers benefits for turning around and selling power plans to their friends and family, primarily over social media.

Clavet and Dean had millions at stake. Their sale to Spark contained an earnout, an arrangement to incentivize Clavet and Dean to continue to build the company’s customer base as the sale was pending.

In Clavet’s words from the witness stand, the earnout depended on keeping “so many customers with a certain profit margin.” That “certain profit margin” was at least 34 percent higher than the going power rate of 6.7 cents, according to sale documents.

Spark provided Clavet and Dean a $2 million budget for that purpose.

Clavet described that marketing as a “futile effort,” because he felt the market was saturated with roughly one in four households signed up.

“Spark had given us a budget to go out and market and try to get those new incremental customers, but it was kind of like banging your head against the wall,” Clavet said.

After $1 million was spent, Clavet said he suggested to Spark that they give him and Dean $500,000 “and [Spark] can keep the other half because this isn’t going to work,” Clavet said.

Spark didn’t accept the offer.

During that time, Clavet claimed Dean “was busy chasing new, individual electricity customers in an effort to hit Spark’s milestones,” an effort he added “did not work, for reasons that were apparent to [Dean] and [Clavet] heading into the effort.” Clavet said he was chasing down big clients during that time, including the AFL-CIO, the United States’ largest federation of labor unions.

In 2017, the company did land such a deal, supplying power to state government at below-market rates. Meanwhile, the company’s average rate for residential customers was 36 percent above the going rate.

Clavet did not respond to multiple requests for comment on his testimony and how he would advise customers to make the comparison between the standard offer and retail supply plans.

How we made the comparison in price

Every year, electricity suppliers report their revenue and total power sales.

From the two annual numbers, broken into groups based on customer size, one can calculate the rate that the supplier’s customers paid, on average.

The rate summarizes all of the complicated activity that might be going on within that number, for customers that signed up in the middle of a year or had their rates change from one month to the next, called variable plans.

Those annual summary reports also break out how much power was supplied in each of Maine’s two regional power grids — most of the state is connected to the ISO-New England grid. Aroostook County and parts of Washington County are part of a separate regional grid system.

The annual summaries for each supplier can then be compared with the going standard offer rates in each different grid system, like so:

This doesn’t consider how retail supply plans can vary from the standard offer (though they rarely do).

For instance, they can have “clean power” attributes, whether the contract is actually backed by a renewable energy project or whether the premium just pays for the cost of renewable energy credits. The PUC report indicated that Clearview Electric was the only provider to only offer such plans through 2016.

For other suppliers, who may offer one such renewable plan, it’s not clear what share of customers have signed up. Public reporting doesn’t show that and industry groups have declined to disclose just how many of their customers choose such plans, as opposed to customers who are getting supply that has no distinction from the standard offer supply.

Darren Fishell is a data visualization specialist and investigative reporter based in Portland. He previously worked as an investigative reporter and business reporter at the Bangor Daily News, where he specialized in energy issues.

This story originally appeared on PineTreeWatch.org, a nonpartisan, non-profit news website based in Augusta. Pine Tree Watch is a product of the Maine Center for Public Interest Reporting.

Event Date

Address

United States